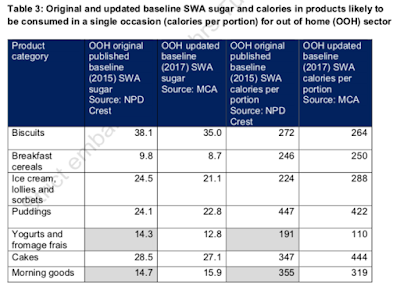

Public Health England has just released its first report looking at the results of its madcap sugar reduction scheme. The idea is to reduce sugar content in most foods by 20 per cent by 2020. The first target was a five per cent reduction by 2017 but, as today's report shows, this has not happened.

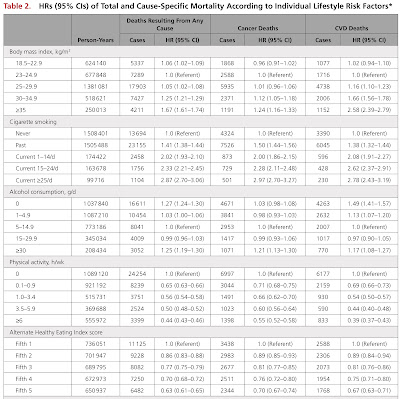

It was never likely to happen. Instead, there has been a two per cent reduction across the eight categories that PHE is most interested in: biscuits, breakfast cereals, chocolate confectionery, ice cream/lollies, puddings, sweet spreads & sauces, sweet confectionery and yoghurts.

The sugar reduction scheme was introduced on the pretext of tackling

the non-existent childhood obesity epidemic, but although PHE initially said they would be only targeting children's foods, they soon admitted that they would be targeting everything because, as they say in today's report...

As children eat a wide range of foods and not just those that are manufactured for or marketed to children, all foods in each category are included.

There was no reduction in sugar content for three of the eight categories and, in some cases, sugar reduction has been accompanied by calorie increases (see below). Great success!

The juicy stuff is tucked away in

Appendix 4 of the report. That's where you can read the case studies sent in by the food companies. If you think your favourite snack has started to taste a bit funny, this is where you can find out what's been done to it in the name of 'public health'.

Similarly, if you suspect that your chocolate bar has been shrinking, head over to the appendix and find out.

As I have said repeatedly, shrinkflation is all part of the Public Health England plan. Once they realised that you can't just take sugar our of chocolate and hope nobody notices, they actively encouraged the food industry to reduce portion sizes.

Here are some of the companies boasting about their miniaturisation work...

Shrinkflation has been variously blamed on

Brexit,

'austerity' and the rising cost of raw ingredients. In fact, the price of

sugar and

cocoa have both fallen sharply since the referendum - the import sugar price reached a record low last year. The ONS noted that these prices had dropped

when it looked at shrinkflation last year. It also noted that whilst shrinkflation can affect any product, sugary products seemed to be particularly heavily affected. It did not, alas, pick up on Public Health England's role in this.

Nor did the consumer organisation

Which? realise that it was government policy to reduce product size

when it complained two months ago about this apparent rip off:

Consumer group Which? accused

manufacturers and supermarkets of misleading customers because they

never announce the cut in pack sizes.

Ratula

Chakraborty, a senior lecturer in business management at the University

of East Anglia, said watchdogs such as the Competition and Markets

Authority should require firms to give customers clear information when

sizes are reduced.

‘Regulatory intervention is needed to

tackle shrinkflation,’ she said. ‘The CMA should require retailers to

inform consumers when product sizes [are reduced] so they are not misled

by these sneaky changes.’

A year earlier, the financial journalist

Andreas Whittam Smith complained that reducing portion sizes without telling customers was a form of fraud:

There have been reports for some time that manufacturers of such

household items as sugar, jam, syrups, chocolate and confectionery have

been reducing the size of their products without making corresponding cuts in their prices.

I say reports because this activity cannot easily be detected by the

naked eye. Somebody has to tell us poor consumers that this shrinkage is

going on because we cannot see it for ourselves. That is the nature of

the fraud.

It is a fraud, isn’t it? If the manufacturer of, say, your favourite

jar of strawberry jam raised the price, you would most likely notice and

then make a rational decision whether to pay up or do without the jam.

But if instead the manufacturer reduces the quantity of jam and

maintains the price, you probably won’t be the least bit aware of what

is going on – unless you study the small print on the label. In short,

you have been had.

Indeed it is a form of fraud; a state-sanctioned fraud. The whole point of the 'health by stealth' approach is to

not tell consumers what's going on. It would be amusing if, as Chakraborty suggested, the government introduced a 'regulatory intervention' to deal with a problem that is being fuelled by government policy.

Food companies need little incentive to shrink their products while keeping the price the same (if you look at Nestlé and Mars in the list above you'll see that they were frantically shrinking their products before the sugar reduction plan officially began - and before Brexit). But the government is now encouraging them to do it. Indeed, it is effectively

compelling them to do it because that is the only realistic way of cutting sugar content in chocolate, confectionery and biscuits, which are the main sources of sugar (see below).

So that's two per cent down, eighteen per cent to go - and they've only got two years to do it. This bonkers idea needs to be knocked on the head before it does any more damage.

I put out a comment on this for the IEA earlier today:

“Public Health England issued their Soviet-style targets with no understanding of how food is made or what consumers want. A five per cent reduction in one year was always unrealistic because it takes longer than that to develop products, test them and create the manufacturing infrastructure. A 20 per cent reduction is unrealistic under any timeframe and leaves the manufacturers of many products with only one option: reduce the size of the product. We have started to see the rip-off of shrinkflation with chocolate bars and we will see much more of it in the years ahead.

Why is this quango systematically degrading the food supply? Consumers didn’t ask for it, the electorate didn’t vote for it and, when offered an artificially sweetened option, shoppers don’t buy it.”